GST REFUND FOR EXPORT STATEMENT NUMBER 3 ERROR SOLVED

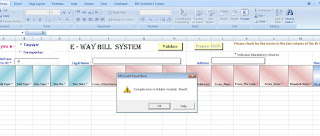

Statement Number 3 for uploading and shows an error "Password Protected" . . "The cell or chart that you are trying to change is protected and therefore read only " Please download the modified file and easily create the json file . This Excel file is unprotected for editing . The issues have been now resolved.. You can subscribe my Youtube Channel https://www.youtube.com/shijoykoratty for more videos. The link also provided at the bottom for downloading the modified file. https://drive.google.com/file/d/1VhGf_fIdc-50C1CrPPbR-UPLOFHfMKn6/view?usp=sharing Shijoy James ASTO SGST Department Kozhikode, Kerala